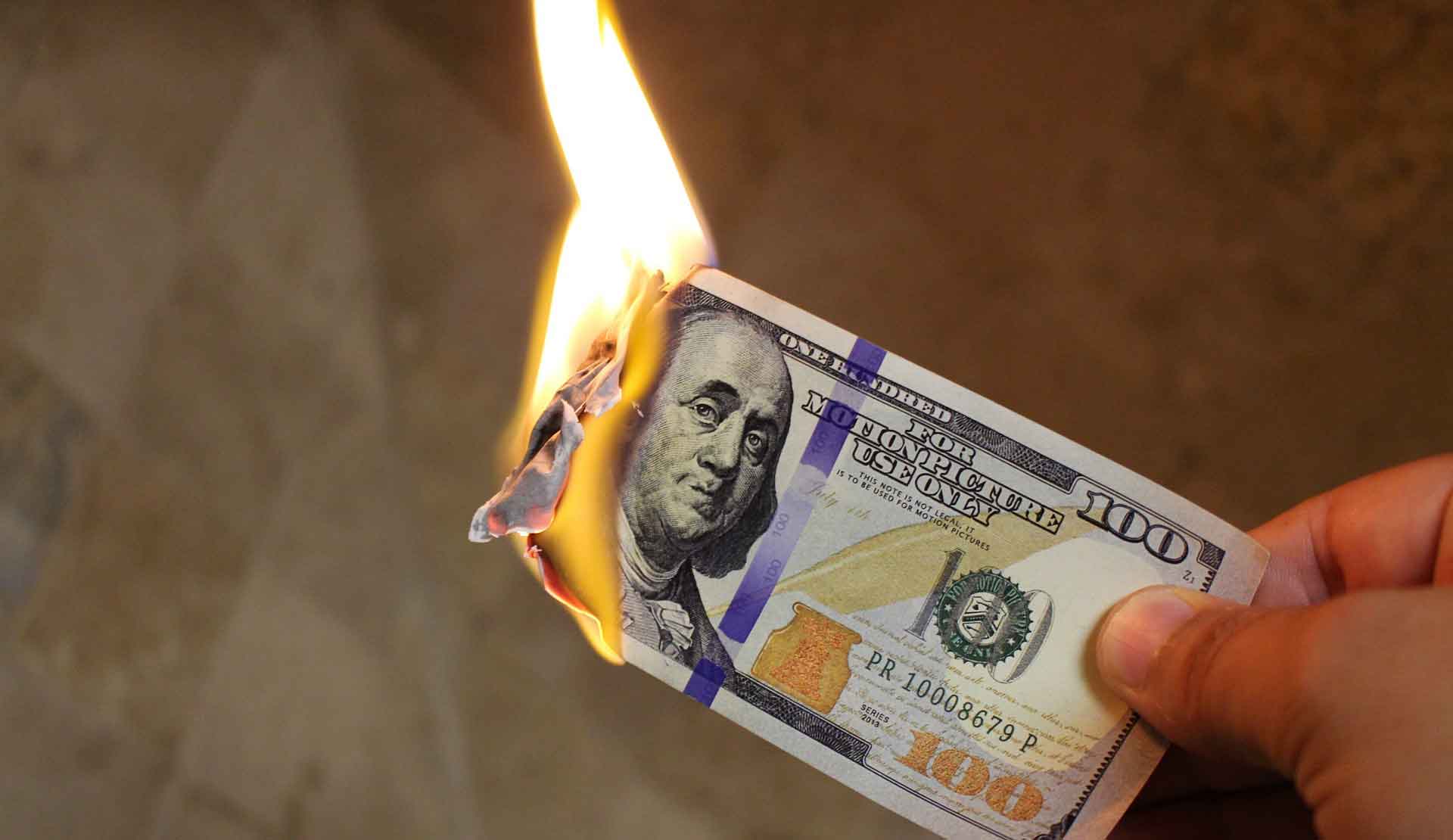

Floridians pay $3,303 more for home insurance than national average.

As if Florida homeowners needed another reminder, a recent study comparing the national average of home insurance premiums found that Floridians are paying higher insurance rates than any other state.

According to a recent analysis of Bankrate data conducted by real estate investor Fire Cash Buyer, Florida homeowners are paying $3,303 above the national average for home insurance.

The study compared the difference in insurance costs to the national average of $2,230 per year. Florida came out as the state paying the highest annual premiums above the national average.

Florida home insurance rates: Are Florida homeowners insurance rates going up again? Maybe not. Here's what we know

Many homeowners in the Sunshine State saw hikes up to 40% in recent years, underscoring the growing environmental risk factors in the state, largely due to continued development along Florida’s 1,350 miles of coastline and an increase in frequency and severity of major hurricanes.

The most expensive county is Monroe County, which includes the Florida Keys, with an average annual premium of $31,687 for homes without wind mitigation, according to Fire Cash Buyer.

Top 10 home insurance per state compared to the national average

Here is how Florida compared to the rest of the states on the list.

- Florida – $3,303 above the national average

- Nebraska – $3,019 above the national average

- Oklahoma – $2,470 above the national average

- Louisiana – $2, 044 above the national average

- Kansas – $1,873 above the national average

- Texas – $1,496 above the national average

- Colorado – $894 above the national average

- Kentucky – $883 above the national average

- Arkansas – $826 above the national average

- Mississippi – $590 above the national average

Average home insurance rate in Florida

According to Bankrate, the average price of home insurance in Florida is $5,533.

Silver lining: Home insurance premiums aren’t expected to increase in 2024

In a May 17 news release, the Florida Office of Insurance Regulation (OIR) announced that property insurance rate filings for 2024 showed a slight downward trend for the first time in years, indicating a stabilization of the property insurance market.

According to the release, 10 companies filed a 0% increase, and at least eight companies filed a rate decrease that will take effect in 2024.

There was also a spark of good news in the reinsurance market. The OIR said the 2023 reinsurance market responded positively to lawmakers’ reforms.

If the time comes and you need to make a claim to your home insurance company, whether for storm damage, wind damage, fire and smoke damage, mold, burglary, or vandalism, we can walk you through it without stress and ensure you receive the full benefit from your policy. We have been helping homeowners and business owners with insurance claims since 2013. Contact us today for a free consultation.

continue reading

Other Interesting and Informative Posts

Floridians filing a homeowners insurance claim had the lowest chance in the 50 states of getting a check from their insurer in 2022, with more than a third of claims going unpaid.

Colorado State University (CSU) weather forecasters on Tuesday increased the number of hurricanes expected in 2024 in the closely watched July update to their long-range forecast.

Leave A Comment